Help Center

Manage Your Account: Tax Lots

How do I edit my client’s tax lots?

If your client has a non-covered tax lot, including for securities purchased in your non-taxable and tax-deferred accounts, you can edit the cost by selecting Edit Tax Lot after selecting View Gains & Losses from the Tax Information page.

If you have more than 24 entries to make for a single security position, you can still enter this information by following these steps:

- Make your first 23 entries; enter the balance of shares not yet entered as the 24th entry and select Update Tax Lots.

- The counter will then reset, find the 24th entry you created with the remaining tax lots from step 1, and on the Open Tax Lots page, select Edit Tax Lot. You can then break out the 24th entry by tax lots. If you have more than 24 extra entries, repeat steps 1 and 2.

What is a tax lot selection method?

A tax lot selection method allows you to choose the order in which your client’s tax lots are relieved and could affect how much your client pays in capital gains taxes. Tax lot selection is also known as Inventory Relief method.

When you decide to sell shares of a security, tax lots will be automatically selected based on the tax lot selection method you have chosen for your client’s account. The sold tax lots are now called realized gains or losses. After deducting losses, any remaining gains will be taxed at either your client’s Short-Term Capital Gains Tax Rate, or their long-term capital gains tax rate.

We offer 10 methods which use different criteria to determine which of those tax lots will be sold. Some use time as the only parameter. Others use value to determine the order. We also offer options that leverage more complex selection criteria that take both time and value into consideration. Additionally, we offer two tax rate weighted options which personalize the selection to take into account the marginal capital gains tax rates you enter for your client.

Automated Tax Strategies

- Strategies to Minimize Capital Gains

- Maximize Losses/Minimize Gains, Tax Weighted: Sell shares in the order of largest effective tax loss to largest gain, adjusted based on your client’s capital gains tax rates.

- Maximize Losses/Minimize Gains: Sell shares with the largest losses first, largest gains last, regardless of long or short-term tax status.

- Strategies to Maximize Capital Gains

- Maximize Gains/Minimize Losses, Tax Weighted: Sell shares in the order of largest effective tax gain to largest loss, adjusted based on your client’s capital gains tax rates.

- Maximize Gains/Minimize Losses: Sell shares with the largest gains first, largest losses last, regardless of long or short-term tax status.

- Other Strategies to Manage Capital Gains and Losses

- First In – First Out: Sell shares in the order that they were purchased from oldest to most recent.

- Last In – First Out: Sell shares in reverse order of purchase from most recent to oldest.

- Maximize Short-term Losses: Sell shares with short-term losses (large to small), then long-term losses (large to small), then long-term gains (small to large), then short-term gains (small to large).

- Maximize Long-term Losses: Sell shares with long-term losses (large to small), then short-term losses (large to small), then short-term gains (small to large), then long-term gains (small to large).

- Maximize Long-term Gain: Sell shares with long-term gains (large to small), then short-term gains (large to small), then short-term losses (small to large), then long-term losses (small to large).

- Maximize Short-term Gain: Sell shares with short-term gains (large to small), then long-term gains (large to small), then long-term losses (small to large), then short-term losses (small to large).

What are tax weighted inventory relief methods?

Tax weighted inventory relief methods use the marginal long and short-term tax rates that you provide to us to determine which tax lots will be sold first.

- To reduce the amount owed in Capital Gains taxes choose Maximize Losses/Minimize Gains, Tax Weighted.

- To increase the amount owed in Capital Gains taxes choose Maximize Gains/Minimize Losses, Tax Weighted.

See below for an example illustrating how we determine the order tax lots are relieved.

- Maximize Losses / Minimize Gains: Sell shares with the largest losses first, largest gains last, regardless of long or short-term tax status.

- Maximize Losses / Minimize Gains, Tax Weighted: Adjust short-term gains/losses based on your client’s capital gains tax rates. Sell shares in the order of largest loss to largest gain.

Here are four tax lots of security XYZ. We will refer to the tax lots as Tax Lot A–D. Each tax lot is labeled with the number of shares, its gain or loss per share, and its status (whether it is a long-term or short-term tax lot).

|

Long-term tax lots were purchased more than one year ago. Short-term tax lots were purchased within the past year. |

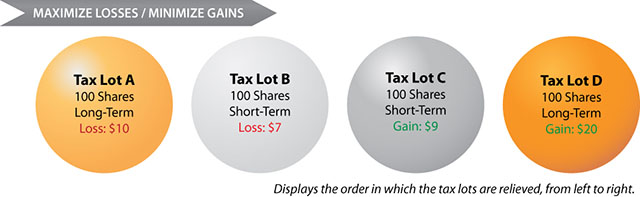

Maximize Losses / Minimize Gains

Using the Maximize Losses / Minimize Gains method, the shares are sold, or relieved, from largest loss to largest gain.

If the account holder sells 100 shares, he will sell Tax Lot A.*

- 100 Shares of Tax Lot A multiplied by $10 per share equals a $1000 Long-Term loss.

- The $1000 loss can be used to offset other sales that had a Long-Term Capital Gain.

- The potential tax savings from realizing this loss is computed below, assuming a Long-Term rate of 15%

- $1000 × 15% = $150

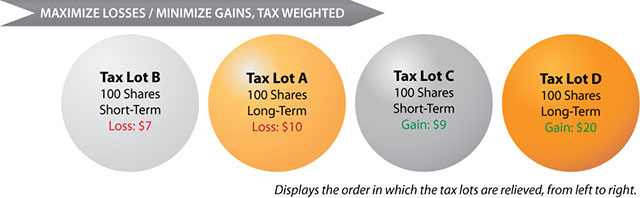

Maximize Losses/Minimize Gains, Tax Weighted

The Maximize Losses/Minimize Gains, Tax Weighted method also sells shares from largest loss to largest gain, but first, it will adjust the tax lots based on your client’s Capital Gains Tax Rates. In order to select this method, the long-term and short-term tax rates for the account holder must be provided. We will determine the factor by which we will weigh the tax lots.

| Short-term tax rate → |

|

← Factor | |||

| Long-term tax rate → |

The Tax Weighted method is using the factor to give more weight to the short-term tax lots because they are taxed at a higher rate. The table below shows an equation for each tax lot, where the gain or loss is multiplied by the factor, resulting in a weighted gain or loss.

| Tax Lot | Status | Gain or Loss /Share | Multiply by | Factor | Equals | Gain or Loss/Share Weighted |

| A | LT | $(10) | × | 1 | = | $(10) |

| B | ST | $(7) | × | 2.2 | = | $(15.4) |

| C | ST | $9 | × | 2.2 | = | $19.8 |

| D | LT | $20 | × | 1 | = | $20 |

Note: The Gain/Loss Weighted column, created by the factor, is a mechanism used to determine the order in which tax lots are sold. The value of the tax lot does not change.

Using the number in the Gain/Loss Weighted column, we have a relief order that differs from the Maximize Losses/Minimize Gains method.

If the account holder using this method were to sell 100 shares, they would sell Tax Lot B.*

- 100 Shares of Tax Lot B multiplied by $7 per share equals a $700 Short-Term loss.

- The $700 loss can be used to offset other sales that had a Short-Term Capital Gain.

- The potential tax savings from realizing this loss is computed below, assuming a Short-Term rate of 33%

- $700 × 33% = $230

- In this example, the tax savings is $80 larger than the savings realized using the Maximize Losses / Minimize Gains method because the tax rate differential makes a smaller Short-Term loss more valuable than the larger Long-Term loss.

- The same logic makes the weighted method beneficial when selling lots with a Capital Gain. Because of the tax rate differential, Short-Term gains are increased by the weighting factor when determining the order that the tax lots are relieved.

*This example has been simplified to illustrate differences between two inventory relief methods. In this example, we have assumed a long-term tax rate of 15% and a short-term tax rate of 33%.

How do I change my client’s automatic tax lot selection?

Change your client’s tax lot selection on the Accounts section of the Settings page.

How do I import my client’s tax lots into tax preparation software?

Download the file produced by selecting Tax Software under the account name in the Form 8949 & Closed Tax Lot Downloads section of the Tax Center tab on the Statements & Tax Records page.

Instructions for importing files into tax preparation software are provided by the companies that produce the tax preparation software. If you or your Client has further questions on importing a file into tax preparation software, please contact the tax preparation software company.

Note that file uploads are not supported in the online version of some tax preparation software. Also, there are limits on the supported number of tax lots in tax preparation software (e.g., 3,000). If you have more than that the supported number of tax lots in your downloaded file, you should use our printed list and attach it to your IRS filing.

Provide Tax Information

If you transferred shares to us that did not include the cost basis and tax lots, you should provide their tax lots, the date you purchased the shares and the total purchase price (including commissions) that you paid for the shares. This information is needed to determine your taxes.

N/A will appear in the Estimated Gain/Loss column if you have not provided tax lots.

When you sell the shares, tax lots allow us to automatically find the shares that fit the tax lot selection method you’ve chosen to keep your taxes as low as possible.

You will not be able to enter this information after you sell the shares.

Filter Tax Lots

The tax lot filtering tool, referred to on our site as the Tax Football, will initially render a chart, using all open, short term tax lots with both gains and losses. Tax lots for symbols held in Non-Folio Holdings are not included. Select the term and gains/losses to narrow tax lots only to those that satisfy your filter criteria. Specify inclusions/exclusions at the symbol or tax lot level to filter tax lots even further. The values shown in Tax Lot Info will change to reflect your filter criteria.

Enter Gain/Loss & Cash Proceed Amounts

Enter the amount of cash you wish to generate and/or desired taxable gain or loss. Or enter either one of these values and then use the sliders to specify the remaining value. The point in the graph will move to correspond to the values displayed in the Cash Proceeds and Gain/Loss fields.

Set Order Options

Based on your specifications, you may have the option to select one or all of the following Order Options.

Reinvest

Generate orders using DP.CASH in order to keep the proceeds of this sale within each sub-account.

Apply Security Exclusions

Help manage wash sales by adding the selected securities to the account exclusion list for future transactions. You must remember to remove these exclusions after 30 days.

Override Security Exclusions

Ignore previously excluded securities when placing this order.

Do we store tax lots for Non-Taxable accounts?

Tax lot records are not kept for non-taxable or tax deferred retirement accounts. Because clients pay no taxes when you sell securities in a retirement account, it is not necessary to record specific tax lots or choose a tax lot method. You will still be able to track the performance and capital gains of non-taxable accounts based on the average cost per share.

How can I view clients’ securities and determine if they have long or short-term gains or losses?

Select View Tax Information from the client accounts page, then select View open tax lots.

How can I view the estimated capital gains and losses as I am placing a trade?

- The Preview and Place Order page shows the estimated short and long-term capital gains for your order.

- Select the Tax Lot Details button on the Preview and Place Order page to see short and long-term capital gains for each security.

How can I view the actual capital gains and losses for an executed trade?

Select View Tax Information from the client accounts page, then select View closed tax lots.